Gurugram: Home Credit India, one of the country’s leading consumer finance companies, has released the findings of its third edition of the landmark study, The Great Indian Wallet 2025, titled ‘Mapping India’s Aspirations: The Dreams in Every Wallet.’ The study highlights a paradigm shift in the financial attitudes of India’s lower middle class, with Kolkata emerging as the clear leader in digital payment adoption.

Kolkata at the Forefront of Digital Finance

Kolkata has achieved a remarkable 87% UPI adoption rate — the highest among all metro cities — showcasing the city’s rapid digital transition. However, 53% of residents say they would stop using UPI if transaction fees were introduced, highlighting the importance of cost-free digital services for financial inclusion.

Kolkata households report:

- Average monthly income: ₹33,000

- Average monthly expenses: ₹20,000

- Savings rate: 59% (down by 10 percentage points from last year)

Kolkata’s Spending Patterns

Essential monthly spends:

- Groceries: 36%

- Education: 15%

- Commute: 14%

- Rent: 14%

- Medical needs: 9%

Discretionary spending trends:

- Travel: 44%

- Dining out: 42%

- Movies: 31%

- Fitness & OTT subscriptions: 7% each

Six-month expenditure insights:

- Fashion: 49%

- Travel: 30%

- Electronics: 24%

- Appliances: 14%

- Home décor: 9%

Digital Fraud Awareness and Concerns

With the rise of digital transactions, online fraud is a growing threat in Kolkata:

- 77% of residents are aware of online scams.

- 25% have reported being victims of fraud.

- 52% face regular fraud attempts.

The findings underscore the urgent need for stronger digital literacy and awareness campaigns.

National Insights: Financial Discipline Meets Aspiration

Across India, the lower middle class is displaying a delicate balance between financial discipline and aspirational spending.

- 57% of respondents reported an increase in income (up from 52% last year).

- Average national income: ₹33,000

- Average national expenses: ₹20,000

- Savings have dipped, with only 50% of respondents saving this year (down from 60% in 2024).

Key spending categories nationally:

- Grocery spending has surged to 29% of monthly budgets (up 12%).

- Education has grown by 34%, accounting for 19% of expenses, showing a strong commitment to future generations.

Digital Tools as Growth Enablers

The study reveals that 63% of consumers believe digital tools have made it easier to achieve financial goals, with cities like Kolkata (80%), Jaipur (86%), and Pune leading the digital confidence index.

- UPI usage nationwide: 80% (up from 72% in 2024).

- Online retail transactions: 51% (up from 42% in 2024).

- Online loan applications are now on par with offline applications at 50%, showing growing trust in digital lenders.

Shifting Habits and Lifestyle Trends

India’s lower-middle class is moving away from impulsive materialism towards mindful consumption.

- Local travel has become a preferred lifestyle upgrade, with 31% exploring nearby destinations monthly.

- Fashion shopping remains at 39% but has dropped 20 points compared to previous years.

- Fitness (7%) and OTT subscriptions (6%) are emerging but remain niche categories.

Savings and Borrowing Trends

- 38% of respondents prefer to save in cash.

- Bank accounts (24%), LIC (8%), property (7%), and gold (4%) follow as saving instruments.

- Alarmingly, 12% are borrowing to cover basic needs, indicating financial strain due to rising costs.

Dreams in Every Wallet

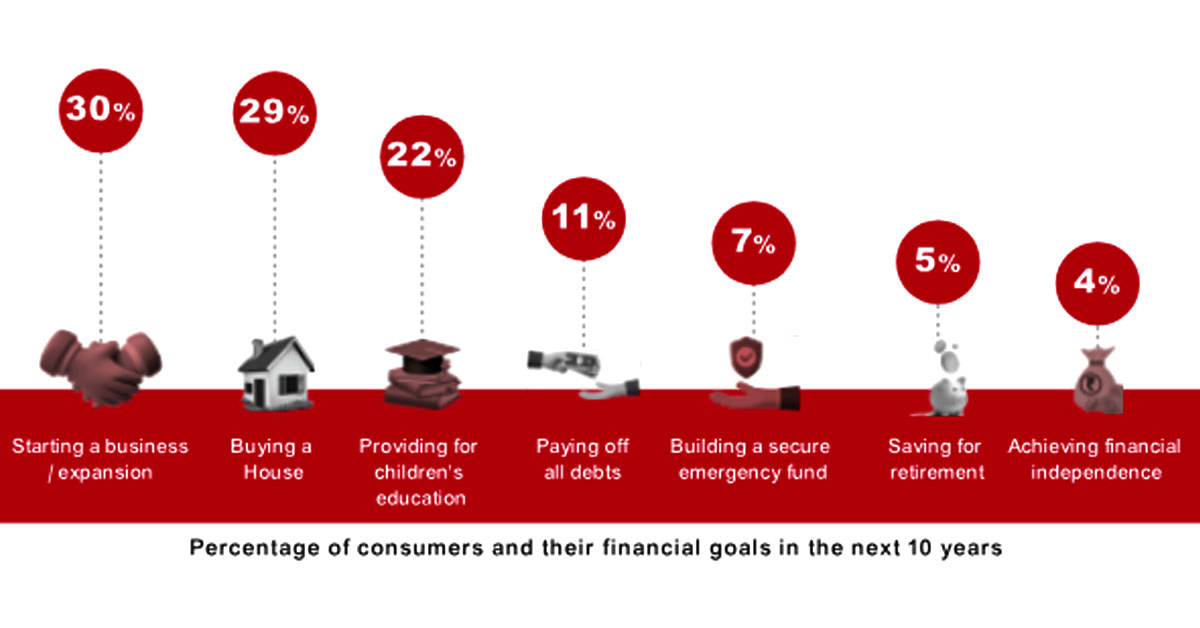

Despite challenges, aspirations remain strong:

- Homeownership and entrepreneurship are top financial dreams.

- 28% believe affordable credit is crucial for achieving these goals, with 65% saying it accelerates their plans.

- 58% of respondents desire financial advice, while women highlight employment opportunities as a key driver of financial progress.

Quote from Home Credit India

“When we initiated The Great Indian Wallet Study in 2023, we discovered a nation of quiet revolutionaries — households turning challenges into opportunities,” said Ashish Tiwari, Chief Marketing Officer, Home Credit India.

“This year’s findings reveal something extraordinary: despite economic headwinds, India’s lower middle class is more optimistic, more digital, and more determined than ever. Their discipline and aspirations inspire us to innovate and partner with them to make their #ZindagiHit.”

About the Study

The Great Indian Wallet 2025 surveyed consumers aged 18–55 years across 17 diverse cities — from metros to Tier-2 towns — to map their financial behaviors, aspirations, and digital adoption. The report underscores the resilience and optimism of India’s lower middle class, emphasizing the need for inclusive financial solutions and robust digital education.